Summary

Summary

A New Format

for Foreign Remittances

For those using foreign remittances services via file transmission, we would like to provide a brief explanation of the effects of ISO20022 support.

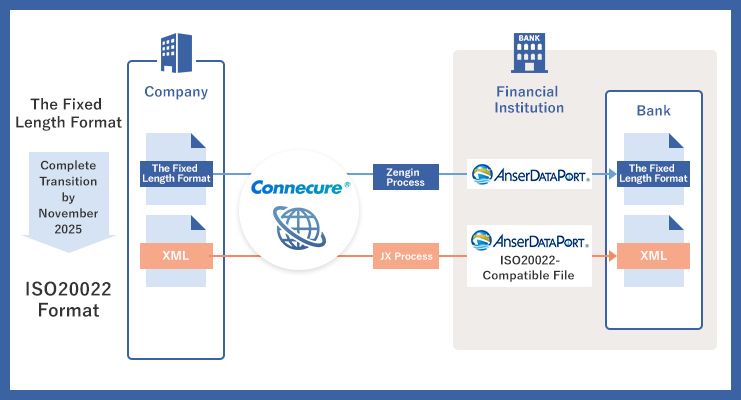

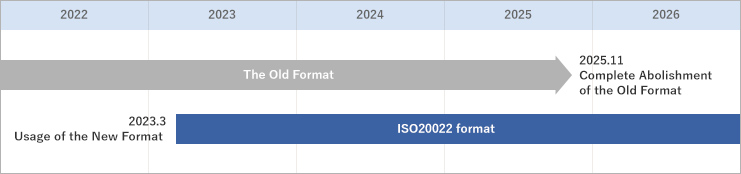

Due to the challenges of foreign remittances, such as strengthening regulations of international anti-money laundering and speeding up remittance processing, SWIFT has announced that it will gradually transition from the current foreign remittance format to the format that supports ISO20022, from March 2023 to November 2025.

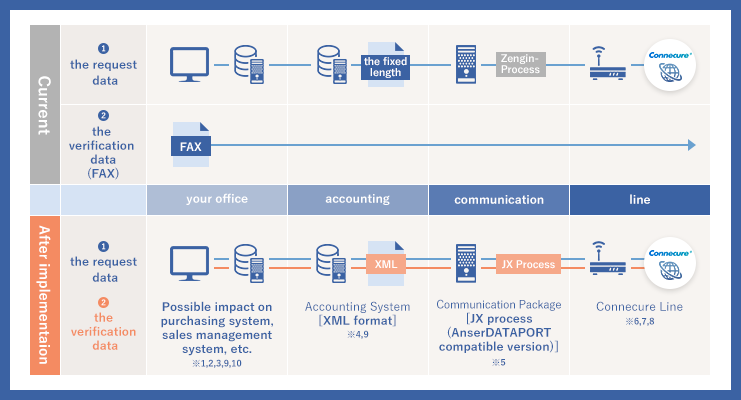

As a result, the fixed length format of foreign remittance sent by companies to financial institutions will need to be changed to an XML format that supports ISO20022 and the transmission procedure.

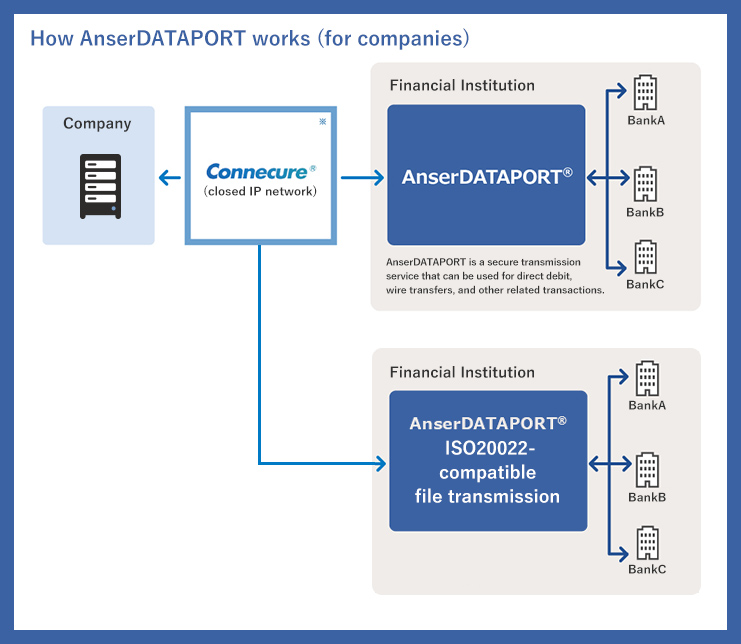

In preparation for the transition to the new format, ISO20022-compatible file transmission service using AnserDATAPORT® can be provided for large companies that use Connecure® lines to handle large amounts of foreign remittances by file transmission.

Please refer to the list of financial institutions that provide this service.

What is SWIFT?

SWIFT, also known as the Society for Worldwide Interbank Financial Telecommunication, is a non-profit organization headquartered in Belgium. It provides a network for financial institutions around the world to electronically exchange cross-border remittance information. It is used by more than 11,000 financial institutions in over 200 countries and regions, and is the international standard for international remittances.

SWIFT plans to start adopting the new format and abolish the old format from March 2023 to November 2025. The old and new formats will coexist from March 2023 to November 2025, and users are required to completely transition to the new format during that period.

What is ISO20022?

ISO20022 is an international standard, established by the International Organization for Standardization (ISO), with the aim of standardizing data formats related to financial services. It has been adopted by SWIFT and for domestic payments around the world as a common format, which allows transmission/reception of abundant information in a form suitable for system processing.

this Service

Merit

Benefits of Using

this Service

If you are already using AnserDATAPORT® for domestic remittances, you can use the same Connecure® for overseas remittances.

In addition, you can send remittances to financial institutions that support overseas remittances (ISO20022) in a common format and with the same procedures.

※Connecure® is a highly reliable network for financial institution transactions that allows businesses to use multiple service centers.

※Connecure® and AnserDATAPORT® are registered trademarks of NTT DATA Corporation.

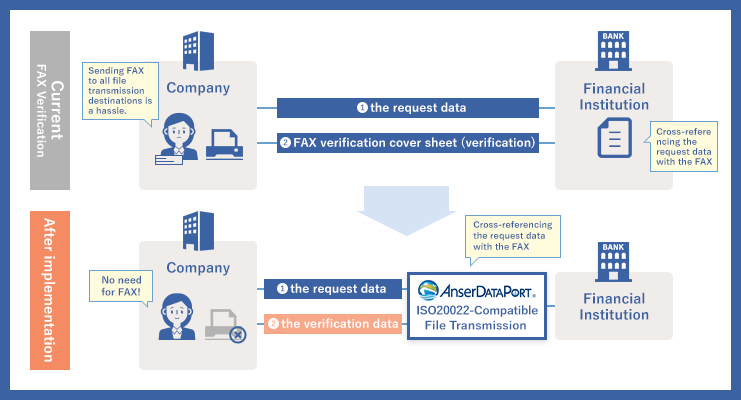

By having the host send the verification data, the verification function of AnserDATAPORT® can be used to automate verification, while also reducing paper usage and improving work efficiency.

※The verification method may differ depending on the financial institution. The following is an example.

Enterprise Preparation

Enterprise Preparation

To use this service, you will need to take the following measures.

| Category | Details | |

|---|---|---|

| ※1 | Adding an Item |

If you add items due to the change to the highly scalable XML format, you may need to add items to the screen input, etc. |

| ※2 | Database Extension | Adding items or making changes to the XML may require extending the database. |

| ※3 | Generating Verification Data | If you wish to use verification data instead of fax, etc. to confirm your intention to remit, you will need to implement a function to generate verification data. |

| ※4 | Switching to the XML Format |

A change from fixed length to XML format is required. |

| ※5 | Switching to the JX Procedure |

A change from the Zengin procedure to the JX procedure (AnserDATAPORT compatible version) is required. If AnserDATAPORT is not supported, communication may not be possible. |

| ※6 | Setting the Result File Acquisition Time | The time when the result file is obtained must be set. |

| ※7 | Connecture Line Application | A Connecure line is required. If Connecure has already been installed, the existing line can be used. |

| ※8 | Construction of File Transmission Infrastructure/ Environment Settings |

The transmission control information required for data transmission with financial institutions will be set in the company's environment. |

| ※9 | Changing Connection Information | You will need to set the connection information to connect to Anser DATAPORT. |

| ※10 | Applying for Services of Financial Institutions | You will need to submit an application form to your financial institution to use the service. |

| ※11 | Operation Consideration | Please consider your company's operational flow, including how to respond to file transmission errors and reception check errors. |

Please contact each package vendor, as managing communication packages and accounting packages will be required. Vendors whose support policies have been decided will be notified on

the list of compatible products.

You can watch an explanatory video about the service overview and download materials from the link below.

ERP Products

ISO20022 Vendor

AnserDATAPORT® ISO20022

for Foreign

Remittance

Compliant Products

and Services

The following information are posted with the permission of each provider.

※The functionality of checking contents such as pain002 may vary depending on the provider. For more details, please contact each provider directly.

※The information provided may not be the most up-to-date, as it is published based on requests from each provider.

※For the connection status to AnserDATAPORT, please check with the respective provider. Additionally, before use, please coordinate with each provider and financial institution to conduct a connection test.

(03/02/2026)

Telecommunication Product List

| 社名 | 製品・サービス名 | 問合せ窓口 | 対応予定時期 | 備考 |

|---|---|---|---|---|

| 株式会社インターコム | Biware(バイウェア)シリーズ | 担当部署:営業部 電話番号:03-4212-2772 メールアドレス:east@intercom.co.jp | 2024年7月25日 | 最新情報は弊社ホームページをご覧ください。 【公式サイト】 |

| 株式会社データ・アプリケーション | ACMS Apex | 担当部署:営業本部 電話番号:03-6370-0909 メールアドレス:sales@dal.co.jp | 2024年9月30日 対応完了 | 2024年7月 AnserDATAPORT外国送金のISO20022対応接続試験完了 |

| NTTインテグレーション株式会社 | EDIPACK21 | 担当部署:バリューコネクト事業本部 電話番号:03-6278-6201 メールアドレス:edi_contact@NIandC.co.jp | 2025年06月対応済 | 最新情報は弊社ホームページをご覧ください。 【公式サイト】 |

| キヤノンITソリューションズ株式会社 | EDI-Master B2B Standard | 担当部署:ビジネスソリューション営業本部 営業部 電話番号:03-6701-3457 メールアドレス:nts-mgr@canon-its.co.jp | 2024年7月1日に対応済 | 本製品や外国送金に関する資料請求は、以下よりお申込みください。 【公式】 |

| EDI-Master Cloud | 2025年4月13日に対応済 | |||

| SCSK株式会社 | スマクラ | 担当部署:スマクラサービスデスク メールアドレス:smcl-sales@scsk.jp | 2024年12月対応完了 | 最新情報につきましては当社のホームページでご確認ください。 |

| ユニリンク株式会社 | EDIWave BMS Center | 担当部署:営業部 電話番号:03-5825-8380 メールアドレス:webinfo@unilink.co.jp | 2024年8月発売 | |

| 株式会社NTTデータ四国 | EBNext2DX for Server | 担当部署:第二ビジネス事業部 営業企画部 EBNext担当 電話番号:050-5556-3006 メールアドレス:ebnext@nttdata-shikoku.co.jp | 対応済み | |

| セイコーソリューションズ株式会社 | 統合EDI構築パッケージ ROS3 | 担当部署:トラストサービス部 電話番号:03-6779-8954 メールアドレス:ros3-sales@seiko-sol.co.jp/seikotrust-edi@seiko-sol.co.jp | 2025年9月 | |

| 株式会社 TOKAI コミュニケーションズ | JFT/Server | 担当部署:法人営業本部東日本事業部営業三部 電話番号:03-5404-3287 メールアドレス:JFT-INQUIRY.tokai-grp.co.jp | 対応済み |

ERP Product List

| 社名 | 製品・サービス名 | 問合せ窓口 | 対応予定時期 | 備考 |

|---|---|---|---|---|

| 株式会社ワークスアプリケーションズ | HUE | 担当部署:パートナービジネス部 電話番号:03-3512-1400 メールアドレス:partner_biz@worksap.co.jp | 対応済 |

List of other services

| 社名 | 製品・サービス名 | 問合せ窓口 | 対応予定時期 | 備考 |

|---|---|---|---|---|

| NTTインテグレーション株式会社 | EDIPACK/ASP | 担当部署:バリューコネクト事業本部 電話番号:03-6278-6201 メールアドレス:edi_contact@NIandC.co.jp | 未定 | |

| EDIゲートウェイサービス | 2024年11月対応済 | |||

| 株式会社JSOL | JSOL-EDI Multi-Bank接続サービス for ISO20022 | 担当部署:カスタマーエクスペリエンス事業本部 メールアドレス:edi-sales@s1.jsol.co.jp 問合せ窓口:https://www.jsolmarketing.jp/public/application/add/16878 | 対応済み。お申し込み受付中。 | ISO20022対応をトータルサポート。各企業の状況に合わせた対応範囲の見極め支援が可能です。 |

| AnserDATAPORT®接続に関する支援 | ||||

| 株式会社インテック | EDIプラットフォームサービス | 担当部署:情流)営業部 メールアドレス:edi_info@intec.co.jp | 対応済み | 最新情報は弊社ホームページをご覧ください。 |

| EDIアウトソーシングサービス | ||||

| データ連携プラットフォームサービス | ||||

| 株式会社オージス総研 | eCubenet「データ伝送サービス」 | 担当部署:営業企画部 メールアドレス:INSIDE_SALES@ogis-ri.co.jp お問合せ:https://www.ogis-ri.co.jp/forms/edi_inquiry.html | 対応済み(お申し込み受付中) | ISO20022対応に伴うお客様の負担を軽減する包括的なサービスを提供します。 |

| eCubenet「データ伝送サービス」外国送金オプション | ||||

| セイコーソリューションズ株式会社 | Seiko Trust EDI | 担当部署:トラストサービス部 電話番号:03-6779-8954 メールアドレス:ros3-sales@seiko-sol.co.jp/seikotrust-edi@seiko-sol.co.jp | 2025年9月 | |

| 株式会社 TOKAI コミュニケーションズ | JFT/SaaS | 担当部署:法人営業本部東日本事業部営業三部電話番号:03-5404-3287 メールアドレス:JFT-INQUIRY.tokai-grp.co.jp | 対応済み |

If you would like to be included in the list, please request with the inquiry form below.

Institutions

ISO20022 Bank

AnserDATAPORT®

List

of Financial

Institutions Handling ISO20022

for Foreign

Remittance

※The numbers in parentheses next to the institution names indicate the financial institution codes.

※They are listed in order of financial institution codes.

As of 03/02/2026

Questions

FAQ

Frequently Asked Questions

1:Common

-

Q1.What is the scope of transactions covered by AnserDATAPORT®

foreign remittance ISO20022 compliance? -

A.

They apply only to requesting data for foreign remittances; other foreign exchange transactions and domestic exchange transactions are not subject to ISO20022 compliance.

- Q2.What financial institutions are available?

-

A.

Please refer to the list of financial institutions.

- Q3.When will it be introduced?

-

A.

The addition of functions for AnserDATAPORT is scheduled for the second half of 2024, but the start date of the service implementation varies by the financial institutions, so please check the list of financial institutions and contact your bank.

2:For Companies

- Q1.I have already connected my financial institution to AnserDATAPORT,but can I still use the existing Connecure?

-

A.

You can use your existing Connecure line. Even if the destination bank is the same, the destination IP address will be different for domestic remittance and foreign remittance.

Also, if you specified a destination IP address with NAT settings when applying for an existing Connecure line, you will need to apply for a change to the settings of the Connecure line.

- Q2.Can I continue to use the same communication and accounting software that I have been using up until now?

-

A.

The request file sent to financial institutions will be variable length (XML format) instead of the conventional fixed length. In addition, the communication software need to be able to support the JX procedure. Please inquire the communication software and accounting software vendors.

- Q3.If I do not use this service, what will happen after November 2025?

-

A.

Other means will be required, such as using internet banking that can transmit requested files in accordance with ISO20022. Internet banking is based on the premise of manual operation while viewing the screen. Meanwhile, AnserDATAPORT supports automatic data transmission from the host, making it suitable for companies that transmit large amounts of files.

- Q4.I want to know the service overview

-

A.

You can watch an explanatory video about the service overview and download materials from the link below.

- Q5.Inquiries regarding the common file format and transmission procedures used in the foreign remittance service using AnserDATAPORT

-

A.

Please contact the provider of the software you use. Software that will become compatible will be listed in the list of products.

- Q6.Inquiries regarding communication software and ERP software used

-

A.

Please contact the provider of the software you use. Software that will become compatible will be listed in the list of products.

- Q7.If I am not using package software and am self-employed in building a system for communication control and format creation, who should I contact?

-

A.

For companies that are self-employed, NTT DATA will disclose detailed specifications and provide explanations. Please contact us using the inquiry form.

- Q8.Will the current Zengin format no longer be able to be sent?

-

A.

For foreign remittance request files, the Zengin format will no longer be available after November 2025. For domestic foreign exchange transactions, the Zengin format will continue to be available.

- Q9.During the period in which the old and new formats will coexist until November 2025, will it be possible to transmit data in both the Zengin format and the ISO 20022-compliant XML format?

-

A.

During the period in which both formats will coexist, both formats will be accepted internationally. However, the timing of the switchover between the old and new formats will vary by financial institution, so please inquire with your bank.

- Q10.Currently, we are sending international remittances in the Zengin format via AnserDATAPORT. Will the ISO 20022-compliant XML format be available via the same route?

-

A.

The ISO20022-compliant XML format can also be used with AnserDATAPORT, but since the destination address is different from that of AnserDATAPORT used with the Zengin format, you will need to change the destination address before sending. However, you can still use the Connecure line you are currently using. (If you have specified a destination IP address, such as with NAT settings, you will need to apply to change the settings of your Connecure.)

- Q11.Will there be a need to differentiate between the Zengin procedure, which is used for domestic general transfers, and the JX procedure, which is used for foreign remittances?

-

A.

Yes, the destinations you’re sending to are different, so you will need to use different methods depending on the destination address.

- Q12.Regarding the layout of the ISO20022-compliant XML format, will only a portion of it be changed to tag format, or will the entire layout be changed?

-

A.

All will be changed to tagged XML format. The Zengin format is fixed length, but the XML format lists all information enclosed in tags for each type.

The result file will also be returned in XML format.

- Q13.Is the ISO20022-compliant XML format the same for all banks?

-

A.

The settings for each item enclosed in tags vary depending on the financial institution, so please contact your bank for details.

- Q14.What is verification data? Is it necessary to send it?

-

A.

After the company sends the request file, instead of the current verification (approval operation) that is done by fax, etc., the company will send the verification data from the host. This will allow AnserDATAPORT to check the validity of the request file, and realize electronic and automated verification. If the bank uses the verification function, it will be necessary to create and send the verification data. As the availability of the verification function and the verification method vary depending on the financial institution, please contact the bank for details.

- Q15.If an error occurs after sending the request file, how can I check it?

-

A.

Currently, when an error occurs, the bank will call you to confirm the details of the error and request corrections, but AnserDATAPORT will perform various checks on the transmitted file and return a result file indicating whether the file can be accepted or not. Regardless of whether there are problems with the contents of the requested file, the company will need to obtain the result file in either case. After checking the details of the error, if there are any problems, please correct them and resend the file.

- Q16.If an error occurs after I send the request file, how long will it take to receive the result?

-

A.

Please check the result file to see if there are any errors.

We recommend that you obtain the result file approximately every 20 to 30 minutes.

- Q17.After sending the request file, do I have to retrieve the result file?

-

A.

Regardless of whether there is a problem with the contents of the request file or not, it is necessary to obtain the result file in either case. However, if the transmission of the request file itself fails, you will be notified of the occurrence of an error at the communication level. In this case, it is not necessary to retrieve the result file, but you will need to resend the request file.

- Q18.Does the result file contain the results of checks made by AnserDATAPORT or by financial institutions?

-

A.

Since the check is carried out in the following two stages, there are two result files: one created by AnserDATAPORT and one created by the financial institution.

①AnserDATAPORT checks the formal aspects of the XML format. If there is an error at this point, it will not be shared with the financial institution, and the result file will be returned from AnserDATAPORT. If there are no problems when checking the request file, and there are also no problems in the verification check when using the verification function, the data will be shared with the financial institution.

②The financial institution will carry out a detailed check of the contents of the ledger, the currency handled, etc. If there is an error in the financial institution check, the result file created by the financial institution will be returned via AnserDATAPORT.

- Q19.After finding an error in the result file, is it possible to correct the request file and resubmit it?

-

A.

Please update your serial number and submit the correct data again.

3:For Vendors

- Q1.I want the connection specifications.

-

A.

A specification disclosure agreement is required to receive the specifications. If you are considering signing into a specification disclosure agreement, please contact us using the inquiry form.

Telecommunications

and ERP Package Vendors

Information for Vendor

Information for Telecommunications

and

ERP Package

Vendors

This service is aimed at large companies that transmit foreign remittance data from a host computer to financial institutions via file transfer. If you are providing software to such companies, you will need to take action on your side.

If you are considering developing a product compatible with this service and would like to be presented with the connection specifications, a specification disclosure agreement is required between us. For details, please contact us using

the inquiry form.

For inquiries from vendors, please contact

us using form here

Inquiries

Contact

For More Details/

Inquiries

Companies

You can watch the overview video

and download the materials.

Please contact the Connecure

office.

Please check the list of financial institutions and contact your bank.

Communications/

ERP package vendor

Please see the information page for vendors.

Contact Form

Inquiry Form for

Telecommunication

and

ERP Package

Vendors

Thank you for contacting us today. Please check our FAQ for frequently asked questions . If your question is not answered here, please fill in the form below and submit it.